EN10025 S460 Steel and Welded Steel Pipes: Price Trends in Africa and the Middle East

The steel industry remains one of the most vital sectors in global construction, infrastructure, and energy projects. Among the many steel grades and products traded internationally, EN10025 S460 structural steel and welded steel pipes play an essential role across Africa and the Middle East. Their usage spans bridges, high-rise buildings, pipelines, offshore structures, and heavy machinery. Understanding their cost per ton, market trends, and purchasing factors is crucial for procurement managers, contractors, and investors aiming to secure reliable supply at competitive rates.

1. Understanding EN10025 S460 Structural Steel

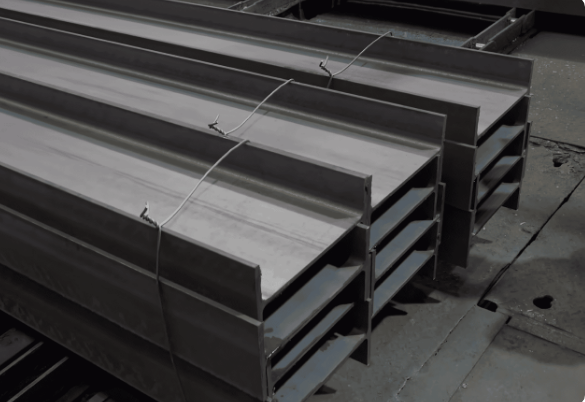

EN10025 S460 is a high-strength structural steel grade under the European standard EN 10025-3. It includes several sub-grades such as S460N, S460NL, and S460M, each designed for specific applications and mechanical performance.

The “S” denotes “structural,” while “460” represents the minimum yield strength of 460 MPa. This grade is widely used in heavy steel construction — such as bridge beams, offshore platforms, and industrial frames — where a balance between strength, weldability, and toughness is required.

Key Properties

- High strength-to-weight ratio: Enables lighter structures without compromising load-bearing capacity.

- Excellent weldability: Suitable for fabrication and modular assembly.

- Good toughness: Performs reliably under varying temperatures and dynamic loads.

- Availability: Supplied as plates, beams, channels, and other rolled sections.

Because of these attributes, S460 is often chosen for modern infrastructure projects across the Middle East and Africa, where design standards are increasingly aligned with European norms.

2. EN10025 S460 Cost per Ton

Typical Market Range

The global base price for S460 structural steel typically ranges between USD 600 and USD 800 per ton for standard hot-rolled plate in large-volume orders. For higher-specification grades such as S460N or S460NL, the price can rise to around USD 1,000–1,400 per ton, depending on plate thickness, dimensions, and certification requirements.

In import-dependent regions like the Middle East and Africa, landed prices — after shipping, duties, and local handling — often reach USD 700–950 per ton. In smaller quantities or for custom thicknesses, costs may exceed USD 1,000 per ton.

Cost Drivers

Several key factors influence the cost per ton of EN10025 S460:

- Material Thickness and Size – Heavier plates or larger sections require more steel input, increasing tonnage cost.

- Grade Variant – S460N and S460NL, with improved toughness and fine-grain structure, attract a higher premium.

- Mill Origin and Supply Chain – Asian mills (China, India) offer lower FOB prices, while European mills charge higher for certified plates.

- Certification and Testing – UT testing, Charpy impact testing, and third-party inspection add cost but are often mandatory for critical infrastructure.

- Logistics and Import Duties – Freight, port handling, customs fees, and inland transport can raise the final price by 10–25%.

- Market Conditions – Global steel prices fluctuate with scrap cost, iron-ore prices, and energy markets.

Regional Insights

- Middle East: S460 is in steady demand for oil and gas infrastructure, high-rise towers, and renewable projects. Major importers include the UAE, Saudi Arabia, and Qatar. Prices typically hover around USD 800–900 per ton for bulk deliveries.

- Africa: Demand is rising in Nigeria, Kenya, Egypt, and South Africa for power plants and transport infrastructure. Import reliance increases landed prices to USD 900–1,000 per ton due to logistics and lower shipment volumes.

3. Overview of Welded Steel Pipes in Africa and the Middle East

Welded steel pipes (ERW, SSAW, LSAW) are indispensable for construction, water supply, oil & gas pipelines, and mechanical applications. Unlike seamless pipes, welded pipes are formed from hot-rolled or cold-rolled steel sheets or plates and welded longitudinally or spirally.

Common Types

- ERW (Electric Resistance Welded): For small to medium diameters, used in water, gas, and structural applications.

- LSAW (Longitudinal Submerged Arc Welded): For large-diameter, high-pressure pipelines.

- SSAW (Spiral Submerged Arc Welded): For oil, gas, and water transmission where cost efficiency is critical.

Market Pricing

In 2024–2025, the average global FOB price for welded steel pipes has ranged between USD 700 and USD 1,200 per ton, depending on diameter, wall thickness, and standard.

Steel prices in Middle East and Africa, landed prices generally average USD 900–1,100 per ton for standard black or galvanized ERW pipes. Coated LSAW or SSAW pipes with FBE or 3-layer PE coatings can cost USD 1,200–1,500 per ton, especially for oil and gas pipeline projects.

Cost Factors

- Raw Material Cost: Hot-rolled coil or plate price directly impacts pipe cost.

- Pipe Diameter and Wall Thickness: Larger diameter and thicker walls increase tonnage and welding complexity.

- Coating Type: Galvanized, epoxy, or 3LPE coatings add significant cost but improve corrosion resistance.

- Testing and Certification: Hydrostatic tests, NDT, and third-party inspection raise cost but ensure quality.

- Freight and Duties: Transportation from Asia or Europe to ports in Africa or the Gulf adds 10–15% to cost.

- Market Demand: Infrastructure investment cycles in oil, gas, and water sectors drive pricing up or down.

Regional Price Averages

| Region | Product Type | Typical Price (USD/ton) |

| UAE / Saudi Arabia | ERW/LSAW Pipes | 950 – 1,050 |

| Egypt / North Africa | ERW / SSAW | 900 – 1,000 |

| Sub-Saharan Africa | ERW / Galvanized | 1,000 – 1,150 |

| Coated (3LPE / FBE) | Oil & Gas grade | 1,200 – 1,500 |

4. Comparative Market Perspective

Both EN10025 S460 structural steel and African welded steel pipes share similar supply and pricing patterns in Africa and the Middle East. The majority of supply comes from Asia (China, India, South Korea), with supplemental imports from Europe and Turkey.

Shared Cost Influences

- Steel Coil Prices: Input cost affects both plate and pipe pricing.

- Shipping & Logistics: Long distances from Asia add freight costs.

- Currency Exchange: A strong dollar often raises import prices for local buyers.

- Regional Demand Cycles: Oil & gas projects, construction booms, and public infrastructure budgets drive fluctuations.

- Energy Prices: Electricity and fuel costs affect production and transport expenses.

5. Procurement Tips for Buyers in Africa and the Middle East

- Request Detailed Quotations: Include specifications such as grade, size, coating, testing, and delivery terms (FOB, CIF, or CFR).

- Order in Bulk: Consolidating orders reduces per-ton cost through freight efficiency and supplier discounts.

- Verify Certification: For EN10025 S460, ensure mill test certificates (MTC) and compliance with EN standards. For pipes, confirm API or ASTM standards where applicable.

- Consider Lead Times: Mills often require 30–60 days for production plus 3–5 weeks for shipping. Plan ahead for large projects.

- Negotiate Based on Market Indexes: Use reference prices for HRC or plate from Asian or Turkish markets to benchmark offers.

- Inspect Before Shipment: Engage third-party inspectors to confirm dimensions, weld quality, and documentation.

- Plan for Duties & Handling: Import taxes, warehousing, and inland transport can add up to 20% to the final delivered cost.

6. Outlook for 2025

The 2025 outlook for steel products in the Middle East and Africa remains moderately strong. As regional economies expand infrastructure, renewable energy, and industrial capacity, demand for high-strength plate and welded pipes will continue rising.

- EN10025 S460 demand is expected to grow with high-rise construction and renewable power projects, especially in Saudi Arabia’s NEOM, the UAE’s industrial zones, and Egypt’s megaprojects.

- Welded steel pipes will see steady demand due to oil and gas pipeline expansions, water supply networks, and urban infrastructure.

However, the price trend may remain volatile due to global steel production shifts, energy costs, and freight rate fluctuations. Buyers are advised to hedge procurement and negotiate long-term contracts to stabilize costs.

7. Conclusion

EN10025 S460 structural steel and welded steel pipes are two of the most critical materials shaping the modern infrastructure landscape in Africa and the Middle East. With S460 priced around USD 700–950 per ton and welded pipes averaging USD 900–1,100 per ton, procurement managers must navigate logistics, certification, and supply-chain variables to secure value and reliability.

Understanding the key price drivers — from raw material inputs and shipping to testing and coating — enables smarter purchasing decisions. In a region where infrastructure growth is accelerating, strategic sourcing, quality assurance, and careful cost planning will remain the foundation of sustainable project success.